Medical records are essential for healthcare providers, patients, attorneys, and insurance companies. These records provide a comprehensive history of an individual’s medical treatment and are frequently used as evidence in legal cases.

However, obtaining medical records often involves fees, prompting questions about their legality and fairness.

This comprehensive guide explores the nuances of medical record fees, their legal basis, associated challenges, and practical strategies for legal professionals managing these costs.

What Does Charging for Medical Records Mean?

Charging for medical records refers to healthcare providers imposing fees for the time, materials, and labor involved in processing requests for these records. This practice is not intended as a profit-making endeavor but rather as a way to offset the administrative burden.

Why Are Fees Imposed?

Healthcare providers manage vast amounts of sensitive data. Retrieving, copying, and delivering records require substantial effort and resources. The main reasons for charging fees include:

Labor Costs

Staff must allocate time to locate, compile, and verify records before release. This process can be even more time-intensive for older, archived records.

Example: A hospital may need to retrieve a patient’s records from an offsite storage facility, requiring administrative coordination and manual searches.

Material Costs

Fees cover the costs of supplies like paper, ink, and printer maintenance for paper records. For electronic records, costs may include data storage devices such as USB drives or CDs.

Example: A provider charging for a paper copy of a 300-page medical file includes the cost of paper, ink, and printing equipment.

Delivery Costs

Providers incur costs for mailing physical records or securing electronic data transfers. These fees ensure the delivery method is reliable and compliant with data protection standards.

Example: A mailed record might include fees for certified postage, ensuring secure and tracked delivery.

Specialized Requests

Additional fees may be charged for specialized services such as creating certified copies, summarizing medical records, or translating records into another language.

Why Understanding Medical Record Fees Matters for Legal Professionals

Medical records are a cornerstone of legal cases, and understanding their associated fees is critical for legal professionals. These fees impact case timelines, client financial planning, and legal strategies.

Ensuring Accuracy of Medical Records

Accurate medical records are essential for building strong legal arguments. Errors, missing details, or incomplete documentation can weaken a case.

Example: A personal injury attorney may need to confirm that medical records accurately reflect the extent of their client’s injuries. Missing treatment dates or diagnostic results could undermine the claim.

To ensure accuracy, attorneys may need to request clarifications or additional documents, potentially incurring extra fees.

Managing Costs and Budgets

Medical record fees can quickly increase, particularly in cases requiring multiple records or extensive documentation. Legal teams must account for these expenses to prevent budget overruns.

Tip: Consolidate requests for multiple records to reduce costs.

Case Example: A law firm handling a mass tort case might negotiate a bulk rate to obtain records for several plaintiffs.

Advising Clients on Financial Impacts

Clients often bear the cost of obtaining medical records, and these fees can be significant. Attorneys must prepare clients for these expenses and incorporate them into settlement demands.

Tip: Educate clients about their rights to access records and potential fee waivers under state laws.

Navigating Legal Complexities

Federal and state laws govern medical record fees. Attorneys must ensure compliance to protect their clients’ rights and avoid legal disputes.

Example: The Health Insurance Portability and Accountability Act (HIPAA) sets federal guidelines for reasonable fees but states like California have stricter rules that limit charges.

Avoiding Delays in Case Timelines

Fee disputes or slow record processing can delay case progress. Understanding fee structures allows attorneys to anticipate potential setbacks.

Tip: Use third-party retrieval services to expedite the process in urgent cases.

Is It Legal to Charge for Medical Records?

Yes, charging for medical records is legal under federal and state regulations. However, these charges must comply with specific guidelines to ensure they are fair and reasonable.

Federal Laws Governing Medical Record Fees

HIPAA Privacy Rule

Fee Guidelines: HIPAA allows providers to charge fees that cover the cost of labor, materials, and postage.

Prohibited Practices: Providers cannot charge fees that create financial barriers to access.

Health Information Technology for Economic and Clinical Health Act (HITECH) Act

Focus on Electronic Records: This law limits fees for electronic health records, reflecting their lower administrative costs.

Direct Transfers to Third Parties: Patients can direct their records to attorneys or insurers without additional fees.

HIPAA Omnibus Rule

Expanded Rights: Patients can request their records in any format and direct them to third parties. Fees must be disclosed upfront.

State-Specific Regulations

Many states impose stricter limits than federal laws, including:

- Caps on Fees: Kentucky and Maine cap the total charges for records at $250.

- Flat Fees: Arizona charges a $15 flat fee for processing requests.

- Electronic Record Discounts: States like Illinois charge lower fees for digital records.

Situations When Fees for Medical Records Are Typically Charged

Fees may vary based on the type of request. Common scenarios include:

Patient Requests

Patients requesting their records may incur fees for:

- Labor and materials.

- Delivery costs, such as postage or secure electronic transfers.

Legal or Insurance Requests

Higher fees may apply to requests from attorneys or insurers, reflecting the added administrative burden.

Specialized Requests

Services such as expedited delivery, certified copies, or medical summaries often incur additional charges.

Types of Fees Associated with Medical Records

Healthcare providers may impose various fees, including:

- Retrieval Fees: Cover the time spent locating records.

- Copying Fees: Charged per page, with electronic records generally costing less.

- Delivery Fees: For mailing or secure electronic transfers.

- Certification Fees: For verifying the authenticity of records.

- Summary Fees: For preparing detailed summaries or reports.

Common Challenges and Disputes Over Medical Record Fees

Fee Disputes

Patients or attorneys may challenge fees as excessive or inconsistent with state laws.

Example: A provider charges $1 per page for a 300-page record in a state with a $0.50-per-page cap.

Delayed Access

Fee disputes can delay access to critical records, affecting case timelines.

Transparency Issues

A lack of upfront disclosure about fees can lead to dissatisfaction and disputes.

Practical Tips for Managing Medical Record Costs

- Understand Fee Structures: Familiarize yourself with federal and state regulations.

- Negotiate Fees: Request reduced rates or waivers when appropriate.

- Leverage Technology: Use electronic health record systems to streamline processes.

- Consolidate Requests: Reduce costs by requesting multiple records at once.

So, is it legal to charge for medical records?

The short answer is yes—medical record charges are legal in the United States. However, these charges are heavily regulated to ensure they are reasonable and do not restrict access. Federal regulations, such as the HIPAA, alongside state-specific statutes, govern the fees providers can impose. These rules aim to balance cost recovery for providers with accessibility for patients and legal professionals.

Exploring Record Retrieval Solutions’ State-by-State Medical Record Copying Fees Resource

Understanding the variations from state to state is one of the most challenging aspects of navigating medical record fees.

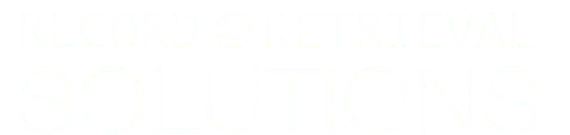

Record Retrieval Solutions (RRS) has created a user-friendly and interactive resource, the State-by-State Medical Record Copying Fees Map, to address this need.

This tool provides detailed information about the costs and regulations surrounding medical record copying fees in each state, serving as a valuable resource for legal professionals, paralegals, and others working with medical documentation.

Key Features of the Resource

Interactive Map Design

The map allows users to click on any state to view the specific regulations and fees for obtaining medical records. This format makes it quick and easy to access relevant information without sifting through dense legal texts or state laws.

Comprehensive Fee Breakdown

For each state, the resource provides:

- Base Retrieval Fees: These fees cover the administrative cost of locating and retrieving records.

- Per-Page Costs: States often impose varying per-page rates depending on the volume of the requested records.

- Additional Costs: This includes fees for certifying records, handling diagnostic media (e.g., X-rays), or expedited processing.

Updated Information

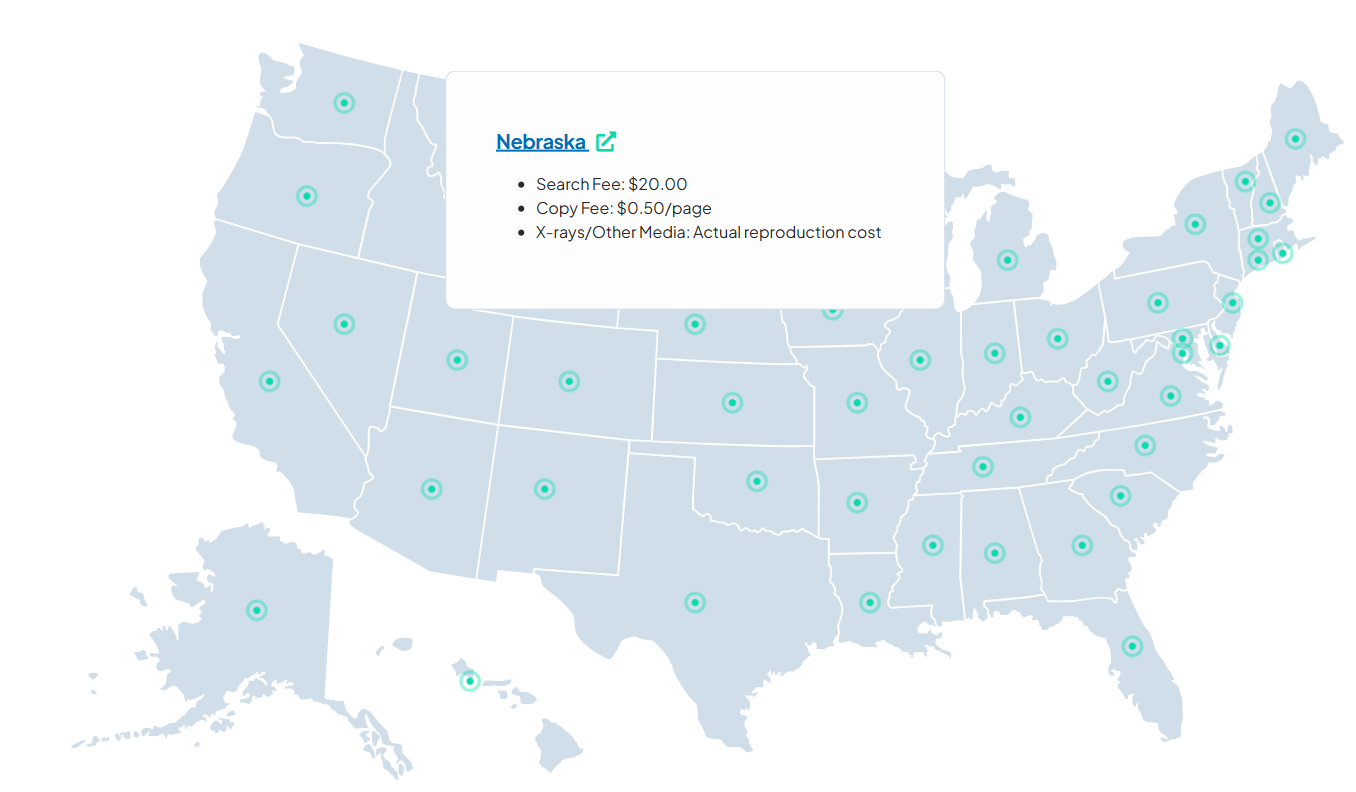

The map is regularly updated to reflect changes in state regulations or inflation-adjusted fees. For example, states like Maryland adjust their fees annually based on the Consumer Price Index (CPI), and these updates are accurately reflected in the tool.

How the Map Benefits Legal Professionals

Clarity and Transparency

Legal professionals often manage cases across multiple jurisdictions. Understanding the nuanced differences in medical record fees for each state ensures compliance with local laws and helps avoid disputes with providers over excessive charges.

Example: In California, the maximum charge for medical records is $0.25 per page, while in Texas, the fees include a base charge of $58.58 plus $1.66 per page for the first ten pages. Knowing these specifics can help attorneys anticipate costs and budget effectively.

Cost Management for Legal Cases

Managing medical record costs is critical to overall case budgeting for attorneys handling multi-state cases or mass torts. This resource enables firms to:

- Identify cost-saving opportunities.

- Consolidate record requests to reduce per-page costs.

- Avoid unexpected expenses by understanding fee structures upfront.

State-by-State Examples

Florida

First 25 Pages: $1.00 per page.

Additional Pages: $0.25 per page.

Special Notes: Fee exemptions exist for public health purposes, such as records for Medicaid patients.

Texas

Retrieval Fee: $58.58 for the first ten pages.

Additional Pages: $1.66 per page up to 60 pages, then $0.81 per page afterward.

Diagnostic Media: Separate fees apply for X-rays or other specialized medical imaging.

Maryland

Flat Rate for Electronic Records: $80.50.

Annual Updates: Fees are adjusted annually based on the CPI, ensuring providers comply with inflation-adjusted rates.

Wyoming

Fee Structure: No charge for medical records, reflecting one of the most patient-friendly policies in the country.

Navigating Common Challenges Using the Map

Understanding Variable Fee Structures

Each state has unique laws governing the retrieval and copying of medical records. For example:

States like Kentucky cap total fees at $250, regardless of the number of pages. Moreover, in Delaware, retrieval fees start at $20 and increase by $0.75 per page.

A centralized resource ensures that users can quickly access accurate information without confusion.

Tracking Fee Exemptions

Certain states offer exemptions for specific situations, such as:

- Records requested for ongoing care.

- Records are needed for public benefit applications like those for Social Security Disability.

Using the map, legal professionals can identify when exemptions apply and ensure clients are not overcharged.

Inflation-Adjusted Fees

Some states, such as Maryland and New York, adjust their fees annually. Staying informed of these changes is crucial for attorneys and paralegals handling ongoing cases in these states.

Practical Applications for Legal Teams

Case Budgeting and Planning

Understanding medical record fees is vital for accurate budgeting for legal professionals working on contingency-based cases. The map allows firms to calculate costs upfront, ensuring they are incorporated into settlement demands or client agreements.

Reducing Administrative Burden

Instead of tasking staff with researching state regulations manually, legal teams can rely on this resource to streamline the record retrieval process. The saved time can be allocated to other critical case preparation tasks.

Enhancing Client Communication

Clients often question the costs associated with obtaining medical records. Using the RRS resource, attorneys can provide transparent explanations of these charges and demonstrate that costs are consistent with state regulations.

Why This Resource Stands Out

The RRS State-by-State Medical Record Copying Fees resource offers unparalleled clarity and convenience. Its user-friendly design, detailed fee breakdowns, and regular updates make it an essential tool for anyone handling medical records in a legal or administrative capacity.

This resource is indispensable for legal teams looking to streamline their processes, manage costs, and ensure compliance. It bridges the gap between complex state laws and practical, actionable insights, empowering professionals to navigate medical record fees confidently.

Explore this resource here.

FAQs

Can healthcare providers charge for medical records?

Yes, within limits set by HIPAA and state laws.

What is the allowable fee for medical records?

Fees must be reasonable and cost-based.

Are there limits on how much medical records can be charged?

Many states cap fees or regulate fee structures.

Do patients have a right to free access to their medical records?

Not always; fees are typically allowed but must remain reasonable.

Can providers charge for electronic copies of medical records?

Yes, but fees for electronic records are often lower.